LOS ANGELES — When COVID-19 forced businesses to shut their doors in March 2020, 30-year-old CEO Jay Barton began crisis-planning for his upstart men’s sportswear company, ASRV.

That week, sales flatlined.

Within a few months, industry mainstays JCPenney, Neiman Marcus and J. Crew filed for bankruptcy, as did the denim companies True Religion and Lucky Brand. Without weddings or date nights, suit-and-tie attire dipped dramatically, too.

Barton mapped out a plan to get through what he anticipated to be a punishing season for his athleisure brand. It was time to slash costs, budget down salaries and hope to stay afloat.

While the pandemic proved apocalyptic for general clothing businesses, athleisure surged to unprecedented heights. Clocking in to work on a laptop meant previously buttoned-up workers swapped out their blazers for the cozy and sporty. In were leggings, shorts and sweat-wicking tees; out was everything else.

Barton — a smart and enterprising founder who had been named to Forbes 30 Under 30 list in 2020 — wildly miscalculated his own company’s fate.

The initial dip in sales at ASRV was a fluke. Sales doubled the following week. More people than ever were opting for stretchier, more comfortable clothing.

"I've never seen anything sell that fast in my life," — Jay Barton, ASRV CEO

Athleisure brands design apparel meant for movement — yoga, running, lifting — but they quickly became go-tos for pandemic inactivity.

What further drove ASRV to a banner year was their expedited release of masks — made of the same stretchy, technical fabric as their apparel. They went from the drawing board to production to sales within a few weeks.

“It was bonkers when we released the masks, I’ve never seen anything sell that fast in my life,” Barton said, wearing a loose-fitting ASRV shirt, athletic-looking ASRV pants and an ASRV cap in his office on a recent Friday. Barton interviewed in his usual work outfit — the same stuff he exercises and relaxes in.

When ASRV’s masks went online in April 2020, the company sold more than 3,000 units in 15 minutes. Customers usually tacked on a pair of shorts or joggers with their mask orders, too, resulting in a 170% jump in sales that first month, according to ASRV chief of staff David Chang.

For all his ambition and foresight, Barton, who was selling shirts before he was in middle school, never could have anticipated that a pandemic would bring the most profitable season his company had ever seen.

The Business of Comfort

The global athleisure market size is expected to surpass $500 billion by 2025. But even before the pandemic it grew at a precipitous rate because of the growing crossover between sports and fashion, as well as the demand for versatile clothing.

Despite a nearly 40% drop in overall apparel sales during the peak of the pandemic, athleisure trended up. Gap Inc.'s net sales, for example, dipped by 19% while Athleta — Gap’s own athleisure brand — rose by 29%.

Barton founded ASRV in 2014. That was after he started two other companies and attended (and then dropped out of) engineering and design school. Compared with sportswear brands like Lululemon, Athleta, Outdoor Voices and others, ASRV is small and young.

They have a devoted, cult-like following on social media (their Instagram has over 1.2 million followers), and stars such as New Orleans Pelicans guard Lonzo Ball, New York Yankees pitcher Aroldis Chapman and singer Alicia Keys have sported their gear.

The brand relies heavily on word-of-mouth. They do not have a brick-and-mortar store and rarely do any self-promotion outside of social media. Fitness enthusiasts post photos in ASRV gear and tag the company’s mantra, #RelentlessPursuit, in the caption.

Barton spoke comfortably about broader apparel history — “casualwear is just getting outdated” — and nanotechnology — “We aren’t far from clothing that is temperature-regulated, that changes colors in the sun.” While Barton is excited about his company’s success during the last year, he had foreseen the athleisure boom long before the pandemic, and noted that it extends well beyond his own brand.

“The pandemic sped up the five-, 10-year process of companies realizing, okay, we don’t need you in the office anymore,” Barton said. “All of a sudden, you’re not going to want to wear a button-up anymore … people want to be comfortable.”

The person who wears ASRV can go to work, complete a workout and grab a coffee all in the same outfit because, according to Barton, everything we wear should be activewear.

Startup cultures and tech companies rarely require a traditional work uniform, and many organizations have allowed employees to work remote for years. Tod Srisengfa has been working remotely since before the pandemic at a tech startup company called Wing.

“The furthest I have to go is on Zoom, and I don’t even need to turn my webcam on,” Srisengfa said. “I can get things done wearing whatever I want, and usually that means I’m wearing my Lulu’s [Lululemon shorts].”

Combined with social trends such as a rise in independent entrepreneurship and healthy living, Barton believes athleisure was already on pace to become the dominant apparel within the next decade. When given the option, innumerable others like Srisengfa opt for versatile activewear they can comfortably work and relax in.

“Athleisure has all the characteristics that you want to be comfortable on the couch, even though it's designed for working out,” said ASRV brand director, Derek Reynolds. “Plus it’s something you still feel cool wearing on a Zoom meeting.”

Burgeoning trends such as body positivity, progressive workplace cultures and the desire to share things on social media helped push athleisure more mainstream, explained Helene Reiner, a professor of fashion history and design at the University of Southern California.

"[Athleisure] is something you still feel cool wearing on a Zoom meeting," — Derek Reynolds, ASRV Brand Director

“At one time you couldn’t wear jeans to work except on ‘jean Fridays,’” Reiner said. “Then it became fine Monday through Friday. Sportswear is comfortable and it’s for leisure, so this [trend] will continue making its way into the workforce after the pandemic.”

Office-goers have enjoyed softer, more versatile wardrobe options in the last year. Asking them to abruptly switch back to non-athleisure items might make people realize they don’t want to revert to how they used to dress.

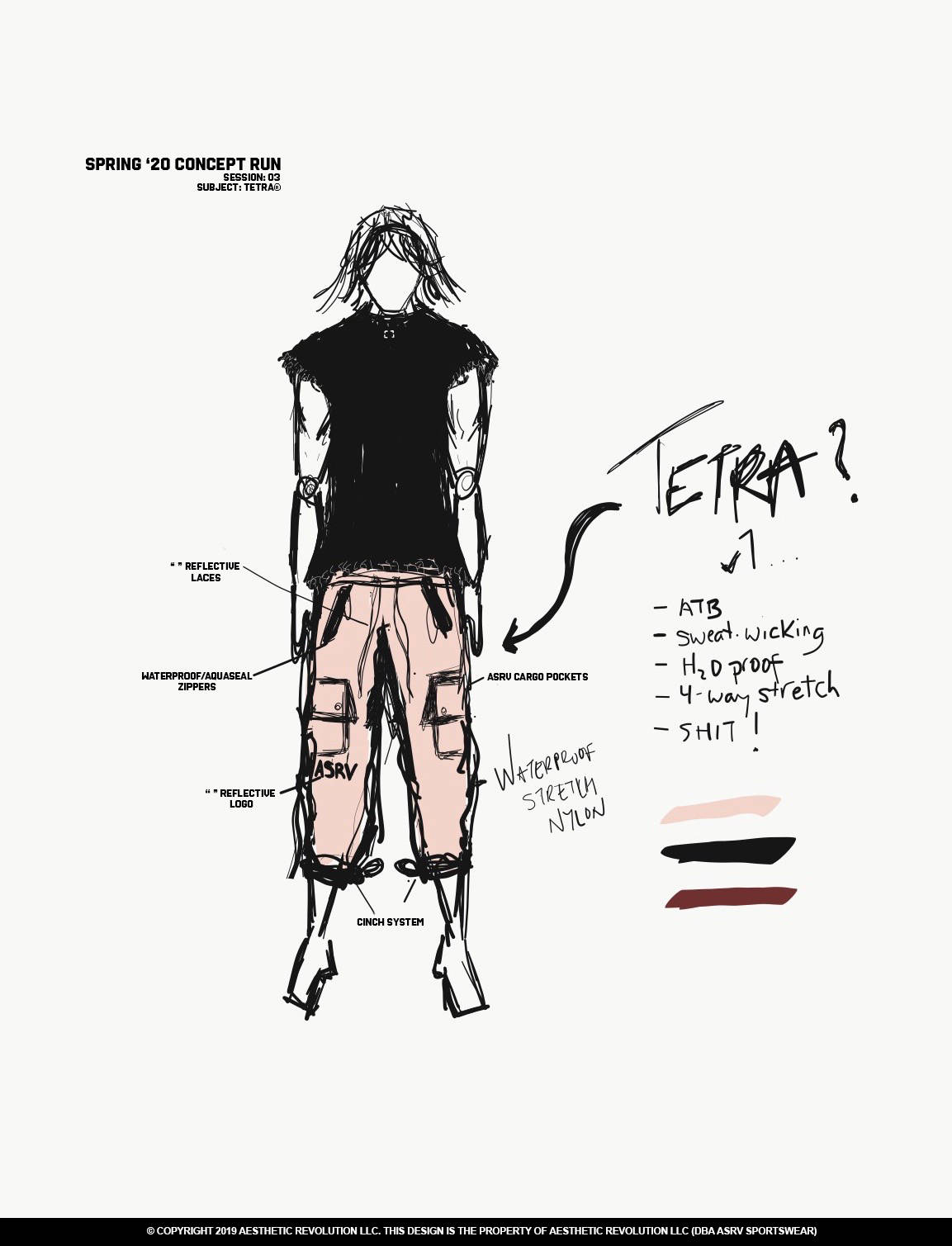

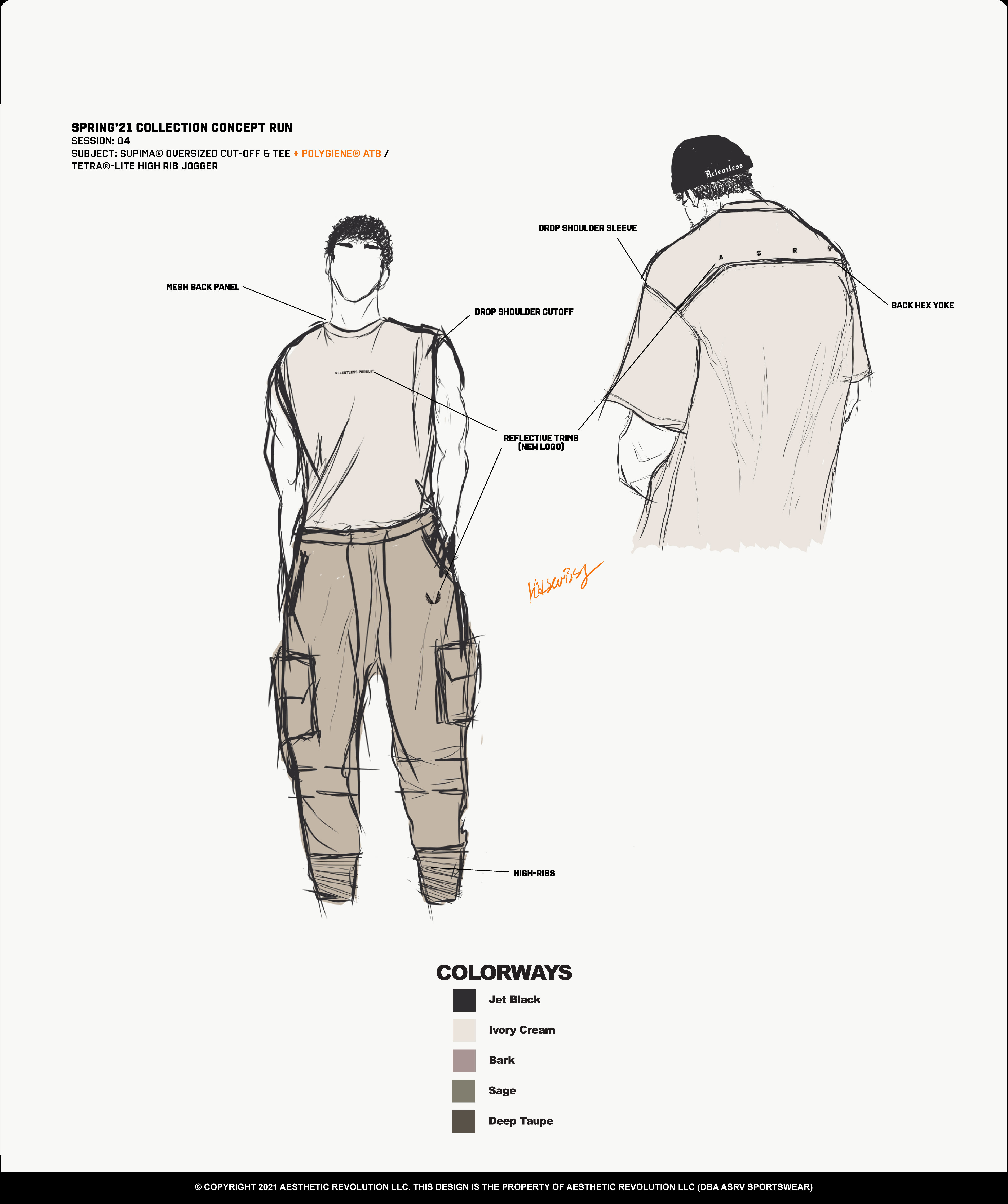

“Business casual, suits and ties, those all go out the window in a pandemic,” said ASRV technical designer and developer Casey Sheehan, who emphasizes versatility in his design sketches (depicted below). “When you’re at home, you have the freedom to wear whatever you want, so more and more people have been picking up athleisure.”

In the past, upper-class citizens would reveal their social rank by having an outfit for every activity of the day: a morning coat, lunchtime coat, shopping suit, bedtime gown and so on. Reiner said we’ve moved further away from that variety, but still use clothes as status symbols.

A shirt from ASRV will cost you about $70, and a pair of high-tech pants go for over $150. Like Lululemon, ASRV sets higher price points because their customers buy stuff in part for the clout — social status, self-worth and the change in how others perceive them.

While some buyers scoff at the lofty prices, others find them more alluring than discouraging.

“Clothes have always been an expression of who we are,” Reiner said. “They boost our confidence and change the way we feel and how other people see us, and this will continue evolving after the pandemic, too.”

Not Your Parent's Tracksuits

The logo for activewear brand Lululemon sort of looks like an upside-down, stylized “U.” In a different light, it also looks like a silhouette of a woman’s wig, or maybe a nondescript Zodiac sign.

The emblem is actually a fancy, modified “A,” the initial for an early name that never caught on — “athletically hip.” Regardless of how it might be (mis)interpreted, the logo is in no danger of going unrecognized: Today Lululemon is worth about $50 billion and is largely credited with making athleisure acceptable in any social setting.

Founded in 1998 by Chip Wilson, Lululemon made athleisure cool. Even 20 years ago, their sweatpants were stylish and their leggings signified status. They sold not only clothing but a lifestyle.

If you wore Lululemon, the idea went, you were fit, chic and had a few bucks.

“Leggings weren’t sloppy anymore after [Lululemon],” Barton said. “They branded it as stuff for a health-conscious person with a Range Rover and a green juice. It’s [someone] trendy, has some money, someone who’s got it together.”

WATCH: Athleisure surged during the pandemic.

Other companies followed suit. Athleta blossomed alongside Wilson’s company near the turn of the century. Nike and Under Armour increasingly fused their lifestyle and athletic apparel. The yoga-inspired Alo launched in 2007 and Outdoor Voices arrived in 2012.

Within a couple decades, athleisure went from fringe to mainstream as it ate away more of the non-activewear apparel market. Since 2000, athleisure brands have enjoyed success: regular gains in year-over-year sales, company value and revenue.

With COVID-19, their successes became astronomical.

“We are seeing a shift in behavior in terms of working from home, sweating from home and the increased importance of living an active and healthy lifestyle,” said Lululemon CEO Calvin McDonald during an earnings call in 2020.

"We had no problem selling our athleisure [during the pandemic]," — Janis Valdez, Lululemon Educator

Gyms had shut their doors yet more people than ever wore athletic apparel — given that 40% of Americans reported gaining weight during the pandemic, an elastic, more forgiving waistband is welcomed.

Lululemon’s earnings growth topped 400% during the pandemic. Los Angeles-based Lululemon Educator Janis Valdez said the company continued to pay employees even when retail stores closed from March to May 2020.

“Our ‘On The Move’ line, like travel and casual pants, haven’t sold much,” Valdez said. “It’s been lots of leggings, sweats. We definitely have had no problem selling our athleisure.”

Many of these companies put cutting-edge fabric technology into their products. It’s no exaggeration to claim the technology in activewear today is more similar to space suits than your parents’ tracksuits.

“Activewear is the new casual wear, and putting tech into apparel is the new frontier,” Barton said.

Mainstream apparel brands such as Abercrombie & Fitch and American Eagle do not specialize in athleisure, but they are pivoting. When you walk into one of these retail stores today, nearly half their shelves are adorned with their take on athleisure — stretchy, technical fabrics akin to Lululemon.

Designers at ASRV are integrating Kevlar technology into some of their product line. It’s the world’s strongest fiber. “You won’t feel the difference, but it’s basically 20 times more durable than anything you own,” Barton said.

Google has already produced a “smart jacket” called Jacquard, which is a blend of interactive technology and versatile apparel. The jacket allows you to control your smartphone from the shirtsleeve, among other features. This type of intelligent, technologically advanced apparel is where Reiner predicts the apparel industry as a whole is headed.

“People need something adaptable, and something that protects them and also benefits them as a consumer,” Reiner said. “This last year is going to spur new technological developments for the future of comfort [in apparel].”

It's what the kids (and everyone else) are wearing

Chip Wilson never set out to create athleisure. He wrote in his memoir that athleisure is for a Diet Coke-drinking woman in a New Jersey shopping mall wearing an unflattering pink velour tracksuit — and that’s not who he intended to wear Lululemon.

Today, everyone wears athleisure: young and old professionals, students, the sedentary and active. Even as the pandemic wanes, the trend isn’t going away.

“More individuals are accepting this new wave of clothes, athleisure, as their everyday outfit,” Sheehan said. “The rest of the clothing industry needs to catch up or they’ll get left behind.”

Reiner predicts many apparel companies will begin to design products that have built in masks or added protection — a zip-up hoodie that also zips into a mask, or a shirt made entirely of bacteria-repellent fabric (ASRV has already implemented ViralOff Polygiene technology into their masks). More features such as these could add to the experience of wearing athleisure and keep it popular for years to come.

“We’ve gotten so used to being comfortable this year,” Reiner said. “When we return to work, everyone will have changed their level of expectations for professional-wear. The comfortable clothes will stay with us.”

As mask mandates across the U.S. have lifted, makeup and cosmetic sales have increased by nearly 25% since May 2021. Restaurants are re-introducing indoor dining and some bars have returned to pre-pandemic capacity.

But even as people begin to rediscover normalcy, Barton’s betting that our pandemic wardrobe isn’t going anywhere.